Robert Sutton, Executive Vice President of Innovation at BNSF Logistics, reviews how month-over-month market and economic factors affect transportation and the supply chain.

.jpg?width=447&name=WarehouseCrossDocking%20(1).jpg)

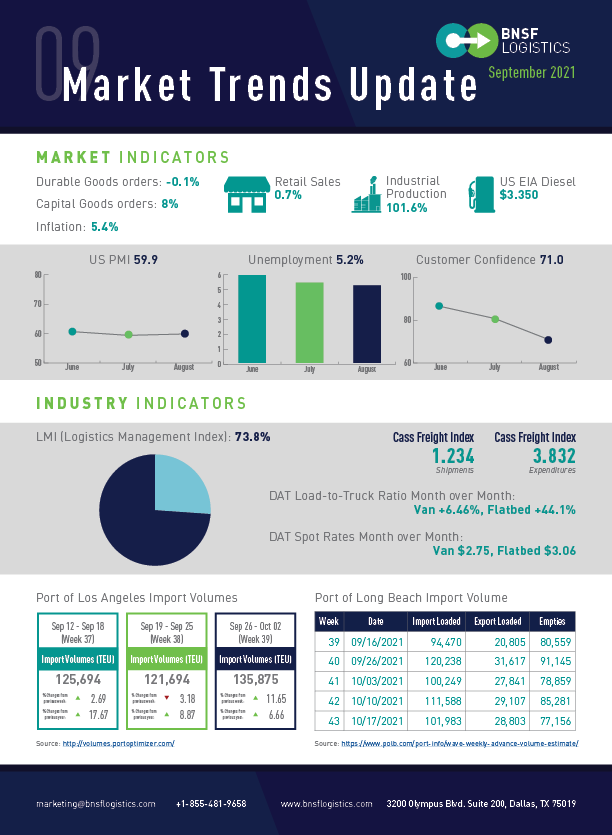

CONSUMERS ARE HESITANT AS COVID CASES RISES, BUT SALES STILL INCREASE

U.S. unemployment in August was 5.2% which was a slight drop from July and follows the trend of gradual but slow improvement. For August there were 235,000 jobs created, which was a drastic decrease compared to July with over 1 million new jobs (2.6 million over the prior 3 months). The economy is still short 5.3 million jobs from pre-pandemic levels without factoring in normal annual growth but with 10.9 million job openings at the end of July, demand is not the issue but rather the availability of workers. Segments of the economy with the most open positions include health care and social assistance; professional and business services; and leisure and hospitality all with 1.8 million openings each

In August retail sales rose .7% to $618.7 Billion. This is encouraging as consumers seemed to shake off concerns related to higher prices from inflation and rising COVID cases. The consumer price index (CPI), which measures inflation, rose 0.3% in September which was the lowest monthly reading since January of this year. Overall inflation sits at 5.3% over the last 12 months and 4% for core inflation. Consumer sentiment, which tends to be a leading indicator, saw a slight increase from 70.3 in August to 71.0 this month. This was some stabilization after dropping precipitously in August to the lowest level since December of 2011.

New home starts rose 3.9% to an annualized rate of 1.615 million units with permits rising 6% to a seasonally adjusted rate of 1.728 million in September. The US is still 5 million homes short of the required need based on 12.3 million household formations that have occurred since January 2012 and only 7 million single-family homes built during this same period. The housing market remains constrained as prices in materials and labor costs increase.

August which tends to be a big sales month for the industry is expected to see sales fall due to continued constraints on production. Customer demand remains high but producers cannot satisfy demand due to limited supply. You can see this by driving by any dealer lot where on-hand inventories have dropped to about one-third pre-pandemic levels. More chip manufacturing is expected to come online in the coming months but expects to continue to see longer lead times and production challenges well into 2022.

SUPPLY CHAIN REMAINS CONSTRAINED DURING LOGISTICS PEAK SEASON

The Purchasing Manager’s Index (PMI) for August was 59.9. Durable goods orders are down 0.1%, which is the 2nd decline in the last 15 months. Durable goods rose 0.7% (excluding transportation equipment). Shipments continue to rise, indicating that these goods are being moved and delivered.

The Logistics Management Index (LMI) for August was down slightly from the previous month at 73.8% but still at an elevated level given that the – the last 3 months represent the highest three-month stretch in the history of the index. Looking at the 3 key factors making up the index (inventories, warehousing, and transportation) we see that capacity is still tightening significantly while demand and utilization remain at very high levels which are driving prices ever higher. For example, container prices from China to West Coast rose to $19,040 in the first week of September (another record high). Additionally, there are reports of 20-mile backups for some rail lines moving through Chicago; record numbers of container ships are sitting at anchor – in some instances up to 2 weeks or more; and not likely to improve soon as August maritime bookings were up 40%.

COVID-19 UPDATE

Delta variant continues to surge with new cases, increasing another 3X since our last update. The 7-day average of new cases is now at 148,000 per day. The vaccination rate has started to increase more rapidly with 25 million Americans having received their initial shot in the last two months.

Blog Home

Blog Home