Director of Market Research, Jeff Greenwell, provides insight into September’s market and industry indicators, current ocean freight market condition, and how this relates to global supply chain strategy.

U.S. MARKET INDICATORS CONTINUE POST PANDEMIC MONTH-OVER-MONTH TRENDS

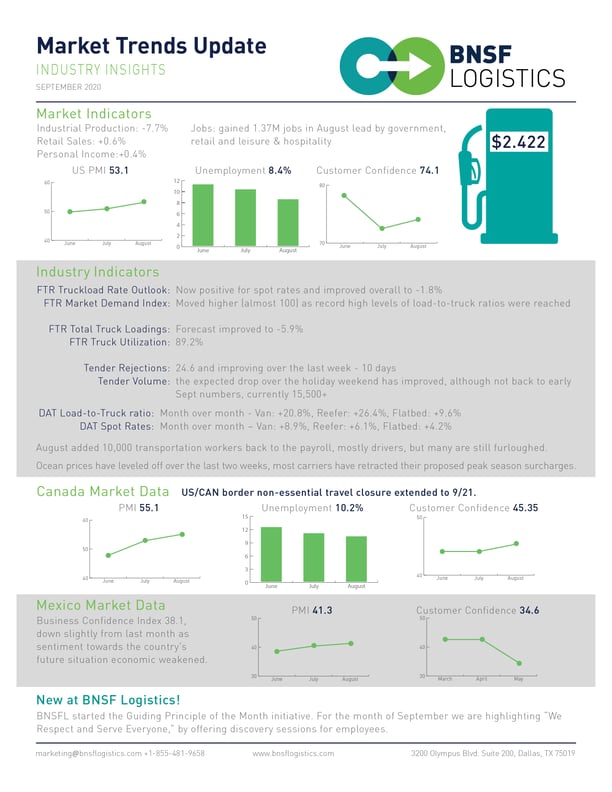

September’s Purchasing Manager’s Index (PMI) is 53.1, exhibiting the strongest expansion and factory activity since Jan 2019. This month also had the first uptake in foreign demand this year. Industrial Production is down 7.7% over last month for the 12th straight month in a row, worsened by the pandemic.

U.S. unemployment is 8.4% - 1.37 million jobs gained in August – lead by jobs in government, retail, and leisure and hospitality.

Consumer confidence is at 74.1 and continues to stay within the 71-78 range shown since April, indicating no marked improvement month over month. Retail is up .6%, led by food and drink services, clothing, and furniture.

CAPACITY LEVELS REMAIN ELEVATED AS SPOT RATES FOR OVER THE ROAD AND OCEAN RISE

Logistics Manager Index (LMI) is at 66% - the fourth month of increase. The LMI shows growth is increasing at an increasing rate for inventory levels, warehouse utilization and prices, and transportation utilization and prices. Growth is increasing at a decreasing rate for inventory levels, warehouse utilization, and transportation capacity.

FTR data shows truck utilization up to 89.2%, still below the 5-year average. Total truck loading improved to -5.9% for 2020, compared to 2019. Truckload rate outlook improved to -1.8% to include contract rates.

Tender rejections have begun to ease slightly over the past week to ten days, dropping to around 24%, although capacity remains very tight overall. Tender volume has leveled off to just over 15,000 over the past few days but is still strong. Demand in e-commerce and typical Q4 spikes may keep these levels elevated through the end of the year. Expect tight capacity and potentially increasing spot rates as the holidays approach.

Ocean rates remain elevated and spot rates have spiked in the last week. Volumes may increase along with tender rejections in the coming weeks as imports tick up for a final push into retail season and higher demand in e-commerce.

DISCUSSIONS OF RE-SHORING AMID GLOBAL MARKET STRATEGIES

As companies reconsider their global supply chain strategies, re-shoring could be considered. Manufacturers most likely will continue to have a presence in China, and some may elect to have an additional manufacturing location as a backup to mitigate risk in case of another world event. Near-shoring to North America may have merit so long as cost, output, and quality are similar to that of current locations.

Blog Home

Blog Home