Robert Sutton, Executive Vice President of Innovation at BNSF Logistics, reviews how month-over-month market and economic factors affect transportation and the supply chain.

RETAIL SALES INCREASE AS HOLIDAYS APPROACH

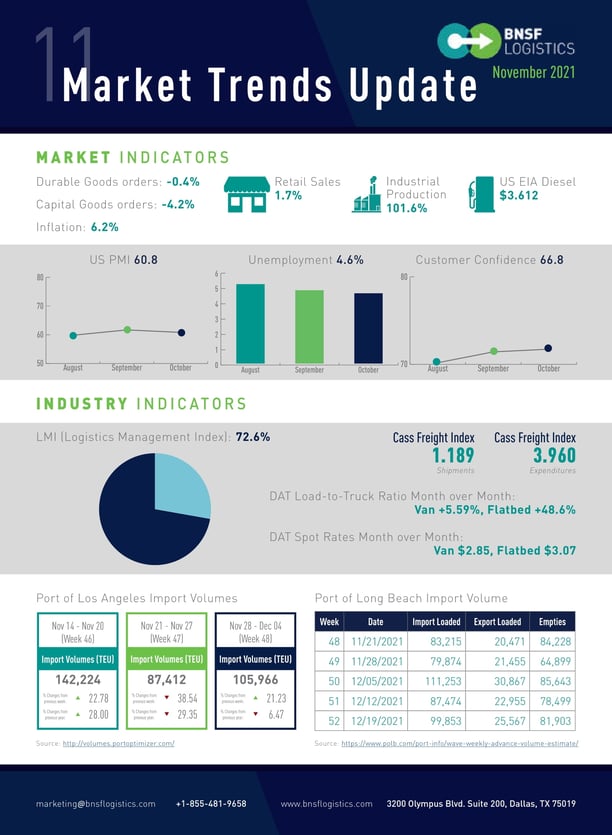

U.S. unemployment in October was 4.6%, a small decrease from September, and follows the trend of gradual but slow improvement. For October there were 531,000 jobs created, which is a large increase from the 194,000 jobs created in September. The gap between employment levels continues to narrow to the 2019 levels, but we are still 4.2 million positions below the pre-pandemic level of employment. There continues to be plenty of open positions, with 10.4 million job openings at the end of September. The challenge here is still the labor participation rate, which has hovered around 61.5% since last summer, equating to roughly 5 million people that have dropped from the labor force and have yet to re-enter. The lack of labor has created real challenges for employers and has driven up wages (up about 5.5% year-over-year through October). The initial jobless claims number continues to decline, reading at 268,000 individuals, which is down only slightly from September’s reading.

Retail sales rose 1.7% in October to $638.2 Billion, which is the highest level on record. Sales are up 16.3% compared to last year and continue to be a major driver of current economic output. This may be in part a result of consumers making holiday purchases early as concerns of supply chain disruptions continue. Sales are expected to rise to about 11% to 13% during the holiday season. Gasoline prices were up 3.8% in October and up over 45% from last year’s prices. The core inflation, which excludes food and fuel prices, was up 4.6% this month while the annualized overall inflation rate was 6.2%, which is the highest level in over 30 years. Consumer sentiment, which tends to be a leading indicator, fell in early November to its lowest level in a decade due to an escalating inflation rate and the belief among consumers that no effective policies have yet to be developed to reduce the damage from surging inflation.

New home starts fell for the third month in a row in October with a seasonally adjusted rate of 1.52 million homes, compared to 1.55 million homes in September, however, this is 0.4% higher than a year ago. Single-family home starts fell for the fourth month straight, while multi-family home starts rose by almost 7%, putting the number of multi-family units under construction at the highest level in almost 50 years. Building permits rose by 4% to an annual rate of 1.65 million in October, which is 3.4% higher than a year ago. Although new housing has been underbuilt relative to demand for years, builders continue to push forward, despite the headwinds brought on by intensifying labor and building material shortages.

Automobile sales inched higher and inventories grew in October, a sign that some of the worst of the shortages affecting auto production might be fading. Automakers continue to struggle to replenish dealer lots, and supply is likely to remain tight through next year. Average vehicle prices will likely remain high, as automakers are choosing to use their chips in pricier, higher-margin vehicles. October’s adjusted annual rate for light vehicles came in at about 13 million, up from about 12.3 million in September. Average vehicle prices are hovering at about $45,000, which is up more than 20% year-on-year. Used vehicles are sitting at an average price of around $30,000, which is up 30% year-on-year. With continued low inventories, automakers continue to unwind incentives and provide fewer promotions for new-car shopping. Despite the long-awaited increase in new-car inventory, average listing prices are accelerated after several months of slow growth.

EXPANSION OF THE LOGISTICS INDUSTRY

The Purchasing Manager’s Index (PMI) for October was 60.8%, which is a decrease from September (61.1%) but overall continues to represent an expansion in the PMI for the 17th consecutive month (anything greater than 50 equals growth). Durable goods orders are down 0.4% while shipments (0.4%), unfilled orders (0.7%), and inventories (0.9%) all increased slightly. Capital goods saw a decrease this past month of 4.2% but were largely influenced by a decrease in aircraft purchases. Excluding aircraft, capital goods actually rose by 0.8% which is a sign businesses are continuing to invest even in light of headwinds of wage increase and scarcity of supply drives up costs.

The Logistics Management Index (LMI) for October increased slightly from the previous month at 72.6%. The LMI index has been above 70 for nine consecutive months, as well as 12 of the past 14 months, continuing a peak unlike any before in the history of the index. This increase is largely driven by decreases in available capacity. It may be surprising that despite the constant talk in the media about “broken supply chains”, the logistics industry is actually expanding. Supply chains have processed more goods than ever in 2021, despite the uphill battle against disruptions. Transportation capacity is down 3.1 points to 34.1% this month, indicating continued downward pressure, while transportation utilization is down 2 points to 67.5%, however, this still indicates continued expansion in transportation utilization. Additionally, transportation prices dropped to 90.7%, down 1.7 points from September. The continued elevation in transportation prices indicates upward pressure on transportation prices. Looking at the other factors that make up LMI, warehousing and inventories, we have seen a minimal decrease of 0.3 points to 47.6% for warehouse capacity, a 3.5-point decrease to 85.8 in warehousing prices, and a decrease of 0.7 points to 85.9 for inventory costs, while the inventory level is up 3.2 points to 61.8%.

COVID-19 UPDATE – VACCINATION RATES RISE WHILE CASES FLUCTUATE

COVID cases have increased in the past month, with a 7-day average of 93,000 new cases per day, however, this is following a drop in cases during late October. Almost 10 million more Americans received their first doses of the vaccine this past month. Nearly 195 million Americans have been fully vaccinated, about 59% of the population. This increase in vaccination rates is partly due to the FDA approval in late October for lower dose vaccinations for children aged 5 through 11.

Blog Home

Blog Home