Director of Market Research, Jeff Greenwell, analyzes the current market growth and freight and ocean volumes as the end of the year approaches.

MANUFACTURING DISPLAYS SMALL GROWTH IN DEMAND FOR NEW ORDERS

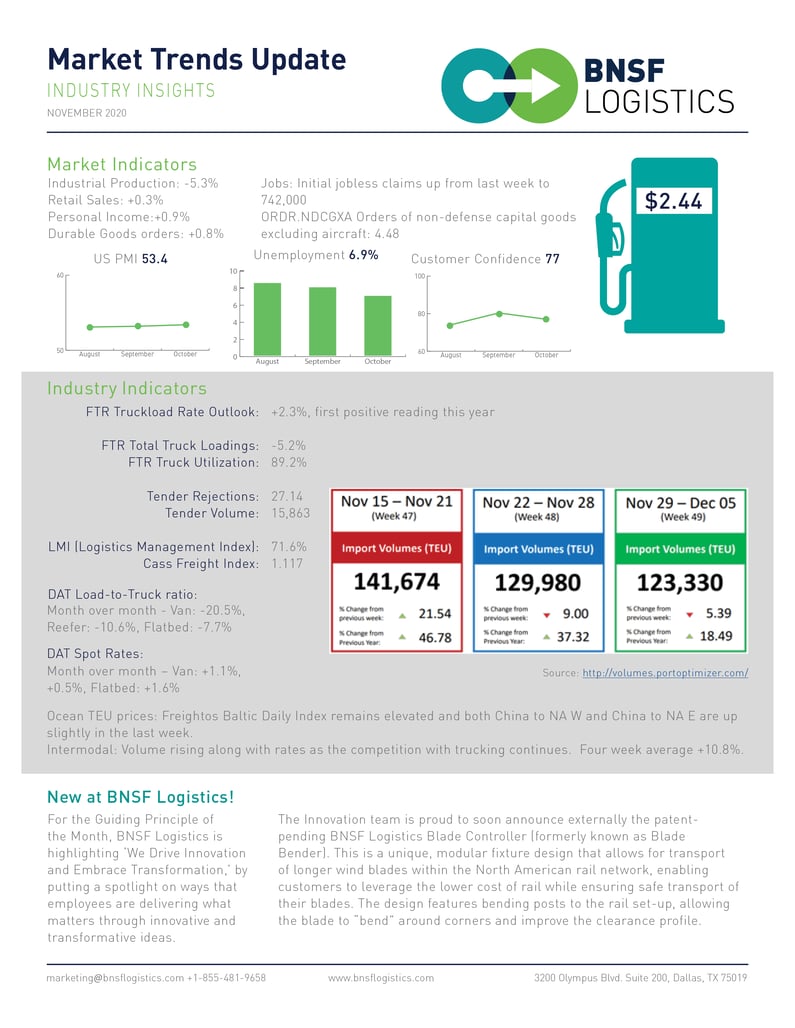

November retail sales are slightly up at 0.3% month over month. Growth is slowing in this sector and increased state restrictions and post-holiday shopping season could curb this even further in the short-term.

Purchasing Manager’s Index (PMI) for November is 53.4 displaying growth for factory activity for the fourth consecutive month; strongest since January 2019 due to stronger demands and higher new orders. Although domestic demand is up, new export orders fell mostly as Europe sees new lockdown restrictions.

Industrial production, the output measurement of the industrial sector, is -5.3% year-over-year – fourteenth straight month of decreased industrial activity. U.S. unemployment for this month is 6.9%, lower than last month with signs of slowing. Consumer sentiment decreased to 77, inflation expectations is up to 2.8%.

Durable goods orders – excluding transportation – is +0.8% on new orders placed to manufactures for delivery of hard goods. Orders of non-defense capital goods – excluding aircraft – is at 4.48, up over last month.

OCEAN AND SPOT RATES CONTINUE UPWARD TREND AS TRUCK CAPACITY TIGHTENS

Logistics Management Index (LMI) is 71.6. The November reading essentially indicates inventories, while lean, are growing which lowers available space. Transportation utilization is still growing but at a slower pace and demand for warehouse space and transportation is slowing.

FTR Total Truckload Outlook for 2020 will be is at -5.2% year-over-year. FTR Truckload rate outlook are +2.3% overall, first positive reading for the year. Cass Freight Index, related to how much freight is moving, at 1.117 for the month, and projected to stay strong until the end of the year.

Tender rejections for contracted loads across the U.S. sit at approximately 27% as of mid-November, and tender volumes are around 15,800. DAT load-to-truck ratio month-over-month is down, with van -20.5%, reefer -10.6%, flatbed -7.7%. DAT spot rates are up month-over-month, with van: +1.1%, reefer +0.5%, flatbed +1.6% for spot rates.

Freightos Baltic Daily Index in both China to North America west and China to North America east lanes are slightly elevated, indicating more volume coming into the ports. Ocean TEU prices remain elevated to current rates since mid-September as imports are high to replace depleted inventories.

Both intermodal volume and rates are rising, with the four-week average +10.8%.

Blog Home

Blog Home