Executive Vice President of Innovation Robert Sutton analyzes current domestic and international concerns with current supply chain, U.S. unemployment and consumer spending.

CONSUMERS REMAIN CAUTIOUSLY OPTIMISTIC AS INFLATION RISES

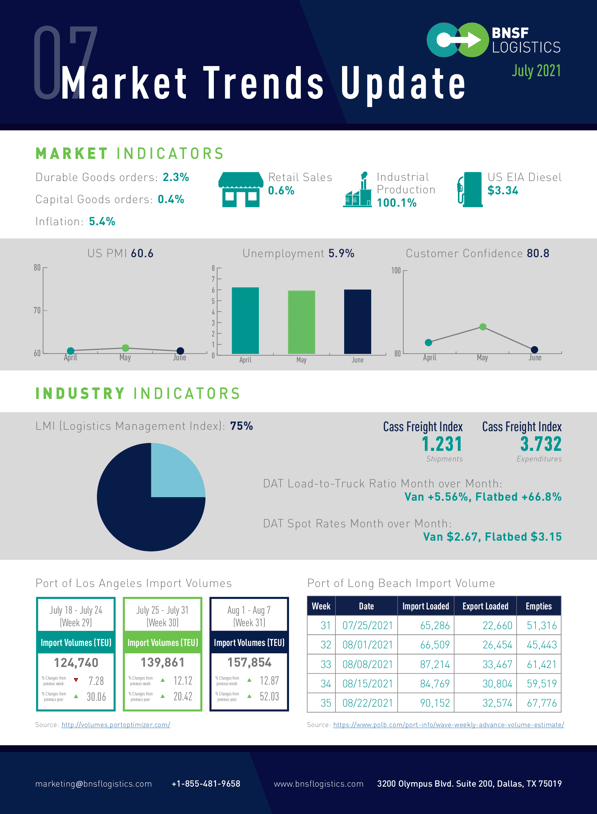

U.S. unemployment is 5.9% with 850,000 new jobs created in the month of June, rising slightly from last month. Labor participation levels were flat, suggesting workers are feeling confident about the job market and willing to leave current employment. Employment for the year has risen by 3.25 million, but with almost 6.8 million fewer jobs than in February 2020 we still have considerable ways to go to get back to pre-pandemic levels. There are currently 9.2 million available jobs, however finding skilled workers to fill those roles has proven challenging. Additionally, the federal supplemental unemployment benefit is keeping some workers sidelined but that benefit ends September 6th, with 26 states already opting out.

June retail sales rose 0.6% compared to previous month which was slightly higher than expected but shows consumers are still flush with cash and willing to spend even though prices are starting to increase.

The consumer price index (CPI), which measures inflation, rose 0.9% in June with total prices up 5.4% over the last 12 months. Energy costs have risen much faster at a rate of 24.5% while the costs of all items – less food and energy – has risen 4.5%. Cost of vehicles both new (up 5.3%) and used (up 45.2%) is driving this increase as production simply cannot keep up with demand. Supply chain costs as measured by transportation services has risen 10.4% in the last 12 months, not surprising given the current imbalanced nature of supply and demand. As costs rise in the supply chain and are sustained they are inevitably passed along to consumers; if current rates continue to accelerate as they have within the last four months this will likely put downward pressure on spending.

New housing starts remain robust and above pre-pandemic levels for the second month in a row with 23% more new homes than this time last year, seasonally adjusted to 1.64 million homes. Inventory has slightly increased for both existing homes and new starts but demand still outweighs supply. While new permits have fallen five out of the last seven months, the decline in input costs (lumber, concrete, etc.) will likely lead to a rise in new permits. Vehicle sales fell, due to lack of available semiconductors, creating challenges for auto industry. Despite lack of inventory, 15.4 million new cars have been manufactured year to date.

MANUFACTURERS CONTINUE TO REMAIN VIGILANT

Purchasing Manager’s Index (PMI) for June is 60.6 growth rate slightly down month-over-month along with new orders (66), and production (60.8), continuing the thirteen-month trend. Backlog of orders, however, indicates strong demand for manufacturing and the need to replenish depleted inventory. New developments with COVID in relation to both domestic and international production are being monitored.

May Durable goods orders is 2.3%, exhibiting the fastest growth since January. Commercial planes primarily drive the increase as airlines see an influx in passengers. Excluding transportation, durable goods rose 0.3%.

SUPPLY CHAIN CONSTRAINTS CONTINUE WITH HIGH UTILIZATION AND LOWER CAPACITY DRIVING INCREASED COSTS

Logistics Management Index (LMI) for June is up over the previous month at 75%. Growth for inventory levels and inventory cost; warehouse utilization and warehouse prices; and transportation utilization is increasing, with growth for transportation prices decreasing. Available warehousing capacity and transportation capacity continues to increase.

Cass Freight Index for shipments is down over the previous month at 1.231 but increased over the previous month to 3.732 for expenditures. Volume has decreased in previous months, with challenges in production and manufacturing being a factor. Peak season this year is expected to be strong driving truckload activity, with rail facing transportation challenges.

DAT load-to-truck ratio are up month-over-month, with van +5.56% and flatbed +66.8%. DAT spot rates are for $2.67 for van and $3.15 for flatbed month-over-month.

COVID’S EFFECTS ON SUPPLY CHAIN

Cases on the rise due to the COVID Delta variant. Last month 11,000 cases per day, now 51,000 7-day average as vaccination rates increase at a decelerating rate; 57% of U.S. citizens have received the initial dose, and approximately 50% of population is fully vaccinated. International manufacturing activity is being monitored; possible global restrictions in southeast Asia can affect global supply chain as factories might close to clamp down on surging infection rates.

Blog Home

Blog Home