Director of Market Research Jeff Greenwell compares this year’s Q1 data to past Q1 metrics, while giving insight into potential topics that might affect shippers in 2021.

MARKET INDICATORS SLIGHTLY DECREASE OVER LAST MONTH; HISTORICALLY HIGH FOR Q1

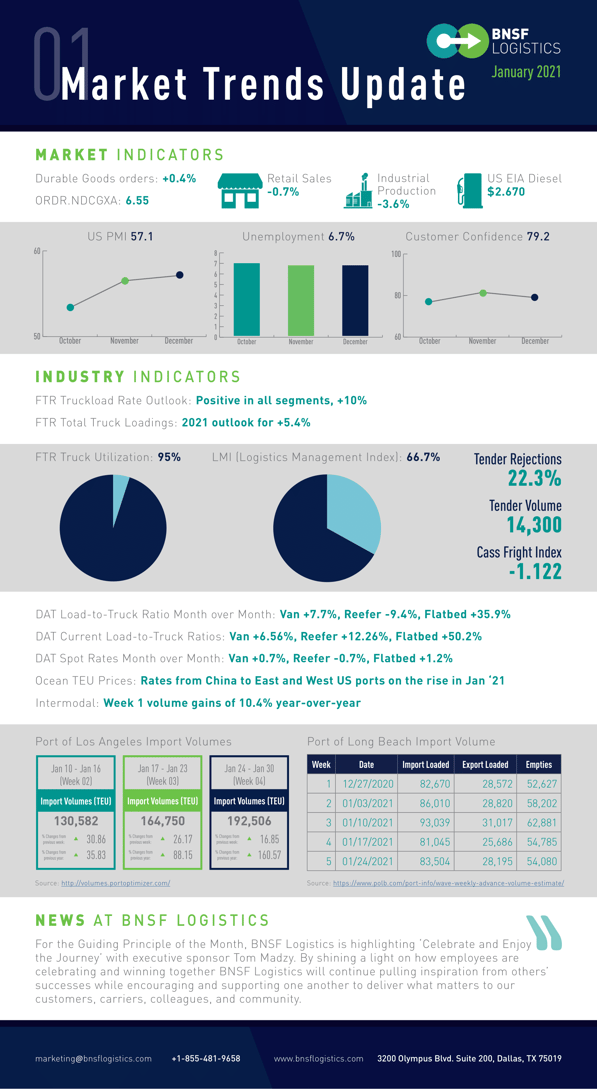

January retail sales is down 0.7%, the largest losses in electronics and appliances, restaurants, bars, and food and beverage stores. Industrial production is -3.6% with the smallest decline since last February. Durable goods orders – excluding transportation – is up 0.4%, and orders of non-defense capital goods –excluding aircraft – is down a half a point to 6.55.

Purchasing Manager’s Index (PMI) for January is 57.1, the strongest one-month growth in activity since 2014. New manufacturing orders are lower due to new COVID restrictions along with a decline in vendor performance, supplier delays, and reduced capacity.

Consumer sentiment at 79.2, down slightly over last month. U.S. unemployment for this month 6.7% - unchanged from last month – indicating the labor market recovery has stalled.

AVALIABLE CAPACITY ACROSS MULTIPLE MODES OF TRANSPORTATION HAS IMPROVED, BUT REJECTIONS REMAIN ELEVATED

Logistics Management Index (LMI) for January 2021 is 66.7%. Growth in inventory levels and cost, warehousing utilization and prices, and transportation utilization has slowed, while contracting of transportation utilization and prices, warehousing capacity, and transportation has decreased, compared to last month.

FTR Truck Utilization is at 95% and projected to remain high until possibly Q4 2021. FTR Total Truck Loadings outlook is up 5.4%. FTR Rate Outlook is positive in all segments, +10%.

Tender rejections for contracted loads across the U.S. improved to 22%, with tender volumes at 14,300. DAT load-to-truck ratio are van: +7.7%, reefer: -9.4%, flatbed: +35.9%, month-over-month. DAT spot rates month-over-month are van: +0.7%, reefer -0.7%, flatbed +1.2%.

Freightos Baltic Index for China to North America east and China to North America west prices are on the rise at the beginning of 2021, with high activity coming into the ports and leading to major congestion in the west. The continued high demand for empty TEU’s overseas indicates an increase in demand for products.

Intermodal is +10.4% in week one 2021 over last year, affecting intermodal capacity and rates.

APPROACH TO 2021 SUPPLY CHAIN DEMANDS

Topics to consider for 2021 that will affect shipping include the continues effects of COVID, the growth of e-commerce, driver capacity shortages and the migration of shippers to the spot market, shorter term rate agreements, and what new logistics technologies need to be reviewed. Consider these issues when creating strategy and budget for 2021.

Blog Home

Blog Home