Robert Sutton, Executive Vice President of Innovation at BNSF Logistics, reviews how month-over-month market and economic factors affect transportation and the supply chain.

RETAIL SALES INCREASE AS WE ENTER 2022

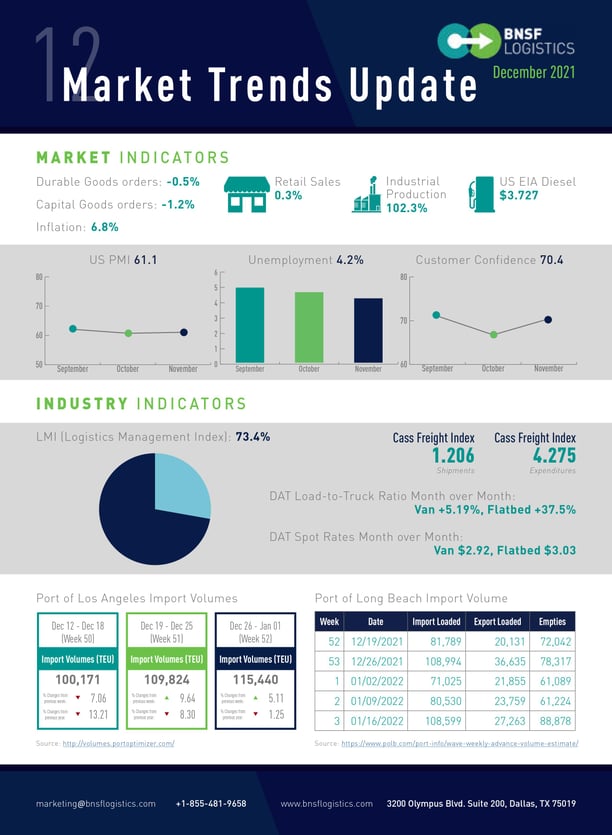

U.S. unemployment in October was 4.2%, a small decrease from last month’s rate of 4.6%, and follows the trend of gradual but slow improvement. Job creation in November (210,000 created) is far less than the 531,000 jobs initiated in October and is the lowest level all year. We are still 3.9 million positions below the pre-pandemic level of employment. The number of open positions increased at the end of October to just over 11 million. The labor participation rate is sitting at about 61.8%, equating to roughly 5 million people that have dropped from the labor force and have yet to re-enter. The initial jobless claims number continues to decline, reading at 204,000 individuals, which is down 25% from last month’s reading. The key remains increasing the labor participation rate to fill these open positions.

Retail sales rose a modest 0.3% in November to $639.8 Billion, which is another record as consumers begin preparations for the holiday season. Sales are up 18.2% compared to last year as consumers focused on purchasing goods during the pandemic. The core inflation, which excludes food and fuel prices, was up 4.9% this month while the annualized overall inflation rate was 6.8%, which is the highest level in over 30 years. Consumer sentiment, which tends to be a leading indicator, rebounded slightly in December from the low reached in November, reaching a level of 70.4, however, this is 10 points below the level from December of last year.

New home starts finally increased a bit in November after three months of declining with an annualized rate of 1.68 million homes, an 8.3% increase compared to November of 2020. Building permits rose by 3.6% to a seasonally adjusted rate of 1.71 million in November. Residential construction continues at a strong pace despite challenges procuring labor and materials.

Automobile sales dipped slightly in November to just over 1 million units sold triggering a decline to the seasonally adjusted annualized rate to 12.86 million units. Monthly sales will likely continue to be dictated by the number of vehicles available rather than by demand as we enter 2022 due to supply constraints hindering production. This is likely to continue as the already strained supply chains and backlogged chipmakers experience further stress from emerging Covid-19 cases.

CONTINUED EXPANSION OF THE LOGISTICS INDUSTRY

The Purchasing Manager’s Index (PMI) for November was 61.1%, a 0.3-point increase from October and matching September. This increase indicates expansion in the PMI for the 18th consecutive month (anything greater than 50 equals growth). Durable goods orders are down for the second month in a row, decreasing overall by 0.5% to $260.1 billion, while shipments (1.5%) and unfilled orders (0.2%) both continue their nominal upward trend for the past several months. Capital goods dropped to 1.2% in October to $83.9 billion. Unfilled orders and inventories both increased slightly by 0.2% and 0.4% respectively, however shipments decreased by 0.1%.

The Logistics Management Index (LMI) for November increased is 73.4, a 0.8-point increase from October. The LMI index has been above 70 for ten consecutive months and 13 of the past 15 months. Transportation capacity was 34.1% in October, indicating continued downward pressure, while transportation utilization is up 5.1 points to 72.6%. Additionally, transportation prices dropped to 90.7% in October, down 1.7 points from September. The continued elevation in transportation prices indicates an upward strain on transportation prices. Looking at the other factors that make up LMI, warehousing, and inventories, October showed a minimal decrease of 0.3 points to 47.6% for warehouse capacity, a 3.5-point decrease to 85.8 in warehousing prices, and a decrease of 0.7 points to 85.9 for inventory costs, while the inventory level is up 3.2 points to 61.8%.

COVID-19 UPDATE – OMICRON VARIANT POSES NEW THREATS

Covid-19 cases have increased in the past month, with a 7-day average of 132,000 new cases per day. This increase is due to the Omicron variant, which accounts for around 75% of the cases. Another 9 million Americans received their initial vaccinations this past month, and 7 million received their second dose, meaning that 61.4% of Americans are fully vaccinated. There is a current concern for potential future lockdowns that may impact the economic recovery and labor participation that we have seen.

Blog Home

Blog Home