Jeff Greenwell, Director of Market Research, reviews current over the road, intermodal, and ocean capacity and rates for the month of December.

CONSUMER CONFIDENCE RISES AS RETAIL SALES SLIGHTLY DECLINE

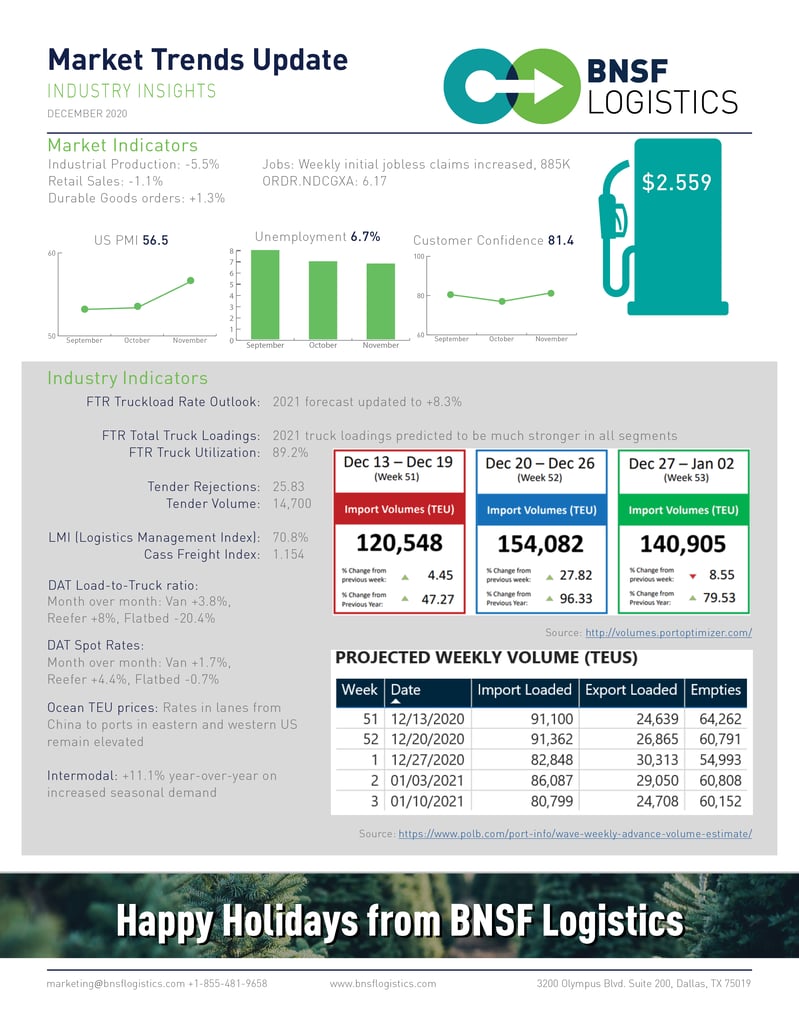

Consumer sentiment is 81.4 going into the holidays; the second highest reading since March. Purchasing Manager’s Index (PMI) for December is 56.5, slightly higher than projected. U.S. unemployment is currently at 6.7%

December retail sales are down 1.1% over last month as clothing stores, bars and restaurants, and electronics and appliances experienced the biggest decline. Industrial production continues downward trend of decreased industrial activity for the fifteenth consecutive month at -5.5% year-over-year.

With new orders placed with domestic manufactures, Durable goods orders – excluding transportation – is up 1.3%, and orders of non-defense capital goods – excluding aircraft – is at 6.17, up over last month.

VAN AND REEFER CAPACITY AND RATES ALONG WITH OCEAN CAPACITY REMAIN ELEVATED

Logistics Management Index (LMI) is 70.8%. The growth of transportation prices continues to increase, while growth in inventory levels and cost, warehousing utilization and prices, and transportation utilization has slowed, compared to last month.

FTR Demand Index is predicted to be stronger in all segments: rate outlook for 2021 is forecasted to be up 8.3%. Tender rejections for contracted loads across the U.S. sit at approximately 27% and updates daily. Tender volumes are at 14,500, declining going into the holiday week. Cass Freight Index is at 1.154 for the month of December. As carriers park for the holiday expect tighter capacity.

DAT load-to-truck ratio indicates van at +3.8%, reefer at +8%, and flatbed -20.4% month-over-month. DAT spot rates, month-over-month, are van at +1.7%, reefer at +4.4%, and flatbed at -0.7%.

Freightos Baltic Index for China to North America east and China to North America west prices continue to remain elevated with a surge in imports. Ocean TEU capacity also remains high. There is higher demand in December for empty containers in China, currently taking priority over exports. Restocking and ecommerce are expected to affect demand during Q1 of 2021.

Intermodal weekly increase is +11.1% year-over-year with increased seasonal demand.

POTENTIAL FOR CAPACITY TO REMAIN TIGHT AND RATES TO STAR ELEVATED IN Q1 2021

For the near future, the case is made for continued tight capacity, elevated spot market rates and increasing contract rates. There are many “what-if’s” in this scenario: rising infection rates, widespread availability of the COVID vaccine, ongoing trade war with China, and any potential pull forward of spring and summer inventories.

BNSF Logistics wishes everyone a safe and happy Holiday!

Blog Home

Blog Home