Jeff Greenwell, Director of Market Research, provides details for August’s domestic and global freight market.

PURCHASING MANAGER’S INDEX SHOWS SLIGHT EXPANSION FOR THE FIRST TIME FEBRUARY OF THIS YEAR

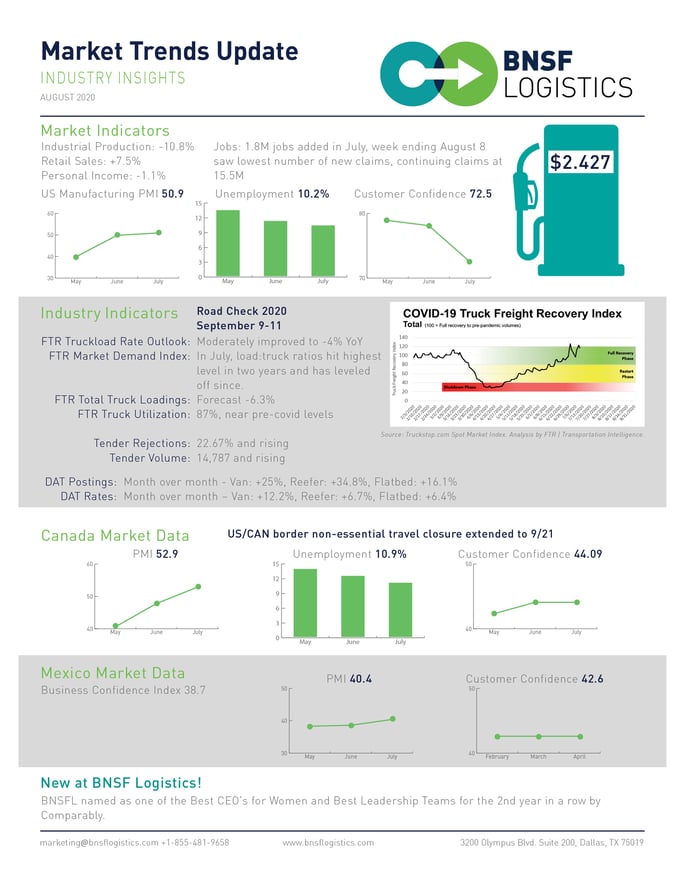

Freight volumes continue to skyrocket beyond pre-Covid numbers as we head into the third month post global shutdown. The U.S. unemployment rate continues to decrease – currently 10.2% - asv weekly new unemployment claims hover around one million. While retail sales are up 1.2% over July, industrial production is still down 10.8% relatively unchanged from July.

Customer confidence is at 72.5 for the month of August. The US manufacturing Purchase Manager’s Index (PMI) is at 50.9, indicating expansion for the first time since the beginning of the year. The U.S. Gross Domestic Product (GDP) for Q2 revealed a 32.9% decline, with the goods component down 11.3% as of mid-August.

BOTH TENDER REJECTIONS AND TENDER VOLUME REMAIN HIGH, INDICATING A RISE IN SPOT MARKET FREIGHT

Truck utilization for the month of August is at 87% nationwide. Truck utilization forecasts are tentatively holding at 85% for the rest of the year, with FTR truck loadings forecast down 6.3%. Tender rejections as of mid-August are at 22.67% and rising. Tender volume also continues to rise daily. Rising spot market postings and rates (month over month – van +25%, reefer +34.8% and flatbed +16.1%) may lead to an eventual rise in contract rates.

The Commercial Vehicle Safety Administration’s 2020 road check has been rescheduled for September 9-11, which will result in tightening of capacity before and during this week.

BNSF LOGISTICS REMAINS OPTIMISTIC ABOUT THE FUTURE

BNSF Logistics is actively staying on top of the challenges and changes arising from the freight recovery . As a part of our guiding principles, we believe in keep our customers, carriers, and employees educated and informed.

Blog Home

Blog Home