Robert Sutton, Executive Vice President of Innovation, summarizes how year-over-year market and industry trends changes transportation needs.

DEMAND FOR GOODS HIT RECORD-BREAKING HIGHS

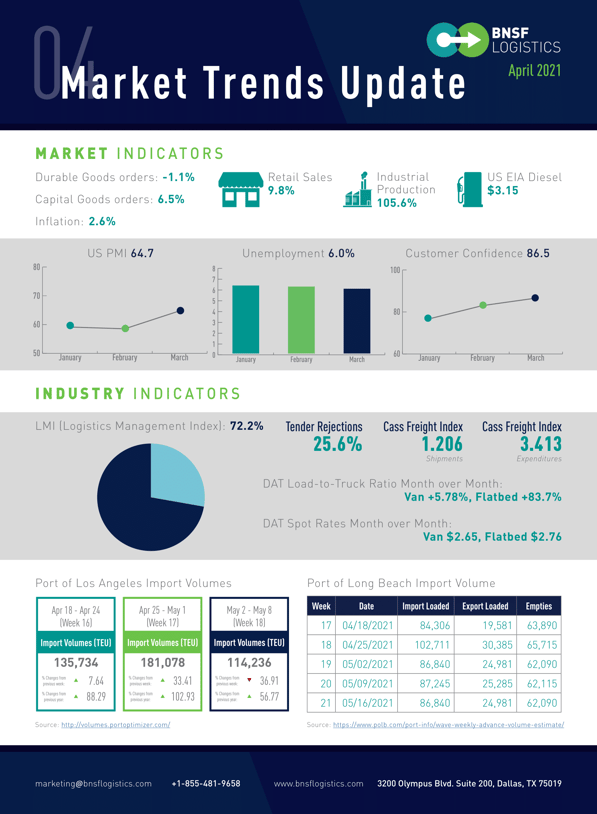

March retail sales were up 9.8% which was significantly increase from February – with autos and auto parts up 15%; clothing up 18.3%; and department stores up 13% month-over-month. The current housing market is extremely busy with 1.7 million new home starts across the U.S. – largest growth areas are in the midwest and south. While lumber prices have soared since last year, this has not put a damper on the market due to low financing costs and a nationwide shortage of available homes (approximately four million).

Consumer sentiment is 85.6 indicating U.S. consumers are comfortable spending. U.S. unemployment slightly declined to 6% with 916,000 new job added in March; labor participation rate is the highest since June 2020 at 81%. Hospitality industry, service industry, and industries related to travelling are expected to see growth as we go further into 2021 and more vaccination rates rise.

Purchasing Manager’s Index (PMI) for April is 64.7, indicating growth in manufacturing. Industrial production is 105.6% overall; demand to replenish inventory is high as sales continue to rise. Durable goods orders – excluding transportation – is down 1.1%, and orders of non-defense capital goods –excluding aircraft – is up 6.5%. Iron ore just reached a 10-year high, driving up steel prices which are estimated to be up 15% over last year. The housing demand coupled with the continued strength of industrials and manufacturing will continue to put pressure on pricing – especially in the flatbed market.

FREIGHT DEMAND LEADS TO HIGH TENDER REJECTIONS

Logistics Management Index (LMI) for April is 72% overall, a +0.9% change over last month. As growth in inventory levels and cost, warehousing utilization and prices, and transportation utilization and prices continue to increase, contraction in warehousing capacity and transportation capacity also continues to increase.

Cass Freight Index is 1.2 this month, indicating capacity for the first half of 2021 will remain tight. Tender rejections for contracted loads remain at approximately 25%. DAT load-to-truck ratio is up overall, with van +5.78%, and flatbed +83.7% month-over-month. DAT spot rates month-over-month shows van at $2.65, and flatbed and $2.76.

Port activity for Q1 hit record-breaking levels; Long Beach moved 2.38 million TEUs, 41% higher than the previous year, and Port of Los Angeles moved 2.59 million TEUs, 44% higher than the previous year. Current spot rate 40ft container is up 200% year-over-year.

ECONOMIC EFFECTS ON SUPPLY CHAIN

Low inventory levels as a result of manufacturing shutdowns last year from the pandemic and high demand for goods will continue to put pressure on the supply chain to replenish stock and to prepare for upcoming peak season. This coupled with challenges in ramping new capacity will cause rates to remain at an elevated level (especially in the spot market across all modes) as demand continues to outstrip available supply.

Blog Home

Blog Home