Robert Sutton, Executive Vice President of Innovation at BNSF Logistics, reviews how month-over-month market and economic factors affect transportation and the supply chain.

INFLATION RATES SURGE

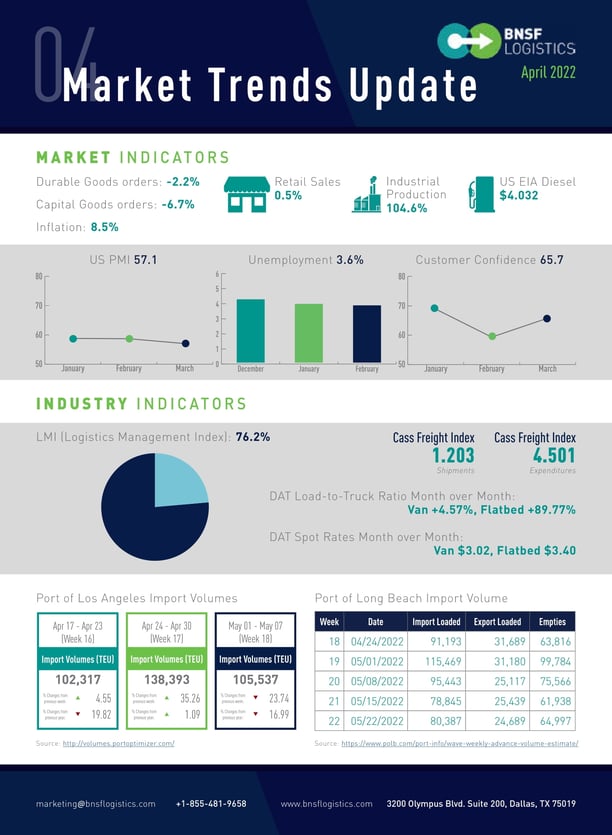

U.S. unemployment in March decreased slightly to 3.6%, down 0.2% from last month nearing the 50-year low of 3.5% that was achieved in early 2020. 431,000 jobs were created in March, and the labor force grew by 418,000 which increased labor participation to 62.4%. However, the labor market remains very tight with over 11 million job openings which are increasing wages. In the last 12-months wages have increased by 5.6%, however, with inflation rising at a higher pace, real wage growth is actually declining.

Retail sales rose 0.5% in March. The annualized rate of inflation rose to 8.5%, which is the highest level since 1982 while the core inflation rate (excludes food and energy), rose 6.5% in the last 12 months. The surge in inflation could begin to subside soon if the price of oil stabilizes and supply shortages finally begin to ease. It could take a few years or even longer before inflation drops back to pre-crisis levels of less than 2%. To fight inflation, the Fed is expected to increase rates by 0.5% in early May after increasing rates by a quarter-point in March.

New home construction unexpectedly rose in March for the second consecutive month. Housing starts increased 0.3% in March to a seasonally adjusted rate of 1.793 million, which is 3.9% above this time last year. Residential permits increased 0.4% in March to a seasonally adjusted rate of 1.873 million. Housing demand remains solid, but the sentiment is diminishing due to material shortages, high costs, and rising mortgage rates.

U.S. new vehicle sales reached 1,249,579 units in March, a 22.2% decrease from March 2021. March’s passenger car sales fell 29.1% to 263,756 units, resulting in a 21.1% market share, while SUV and truck sales decreased 20.2% to 935,823 units, resulting in a 78.9% market share. Light vehicle seasonally adjusted annualized sales for March 2022 reached 13.40 million units compared to 17.79 million units a year ago.

MARCH SEES THE HIGHEST LMI READING IN HISTORY

The Purchasing Manager’s Index (PMI) for March was 57.1%, a 1.5-point decrease from February. This indicates expansion in the PMI for the 22nd consecutive month after the contraction in April of 2020 (anything greater than 50 equals growth), however, this is the lowest reading since September 2020. Durable goods orders decreased 0.3% in the month but are still up 10% over the past year. Headwinds are growing, however, the conflict in Ukraine is likely to tax already strained global supply chains, as could a fresh coronavirus outbreak in China. Capital goods orders saw a decline for the first time since February 2021.

The Logistics Management Index (LMI) for March was 76.2, a 1.0-point increase from February and is the highest reading ever. The LMI index has been above 70 for 14 consecutive months, as well as 17 of the past 19 months. Transportation prices remain high, while transportation capacity contracted in March, but does seem to be loosening through the month and into April. Additionally, transportation prices dropped to 87.6% in March, down 5.6 points from February. Looking at the other factors that make up LMI, warehousing and inventories, March hit a record of 36.1% for warehouse capacity, an all-time high of 90.5 in warehousing prices, and an all-time high of 91.0 for inventory costs. One area that is showing no signs of relief is inventory, where levels continue to rise at a slower pace. Additionally, fuel prices have jumped significantly during the month due to rising oil prices, which tends to impact smaller fleets and owner-operators more so than larger fleets.

Blog Home

Blog Home