In the May Market Update, Managing Director of Strategic Account Management Jeff Greenwell relays freight market conditions amid the recent shutdown of nonessential businesses.

TEMPORARY CLOSURES RESULT IN DECREASE OF INDUSTRIAL PRODUCTION AND RETAIL SALES

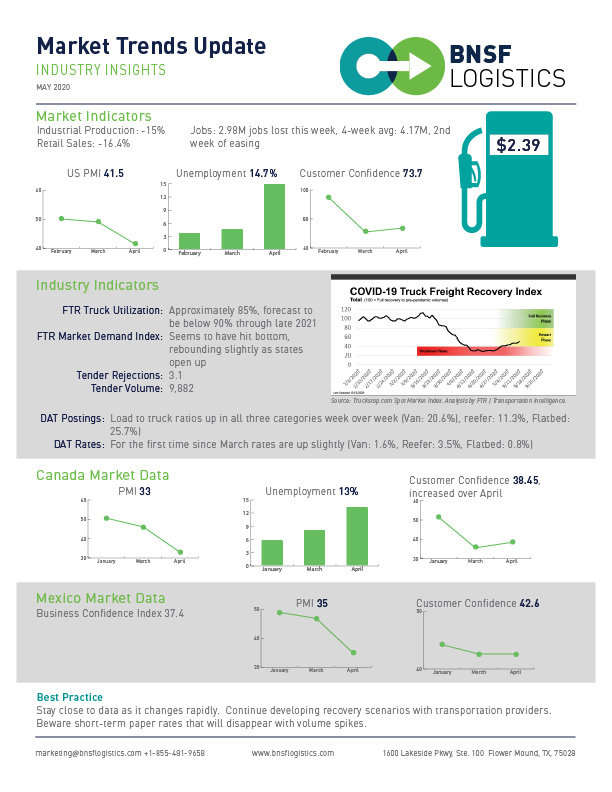

April’s closing of nonessential businesses nationwide is shown in this month’s freight market data. Industrial production is down 15% from last month, along with retail sales, down 16.4%. The Purchasing Manager’s Index (PMI) dropped to 41.5, showing a further contraction over last month.

U.S. unemployment rate is currently at 14.7% with 4.17 million losing jobs in just four weeks’ time. However, job loss due to temporary business closures are reflected, and may be affected as states begin to open throughout May. Customer confidence increased slightly to 73.1.

INDUSTRY INDICATORS SHOW SLIGHT GROWTH

Tender rejections are at 3.2% – a slight rise over last month – with a tender volume of 9,882. FTR truck utilization is approximately 85%. Spot loads have also shown a small increase over last month with load-to-truck ratio up for van (20.6%), reefer (11.3%), and flatbed (25.7%). These are the highest numbers since March.

MARKET RECOVERY

The COVID-19 Truck Freight Recovery Index provided by FTR shows the Market Demand Index hit bottom in April during the shutdown phase. Other estimates for pre-COVID recovery vary with some as early as Q4 this year. Estimates will change as states slowly begin to reopen.

As companies resume business, employees return to work, and new cases are monitored, a slow recovery will build to pre-COVID levels potentially by Q3-Q4 2021.

CLOSING STATEMENT BY BNSF LOGISTICS

Overall, BNSF Logistics anticipates a slow to moderate recovery with a segregated state-by-state approach, based on FTR’s Truck Freight Recovery Index. Our main priority at this time is creating a dialogue with our customers, and to provide the most accurate industry insights to help their businesses thrive.

Blog Home

Blog Home