Director of Market Research Jeff Greenwell offers insight into July’s freight market, and how it relates to industry projections.

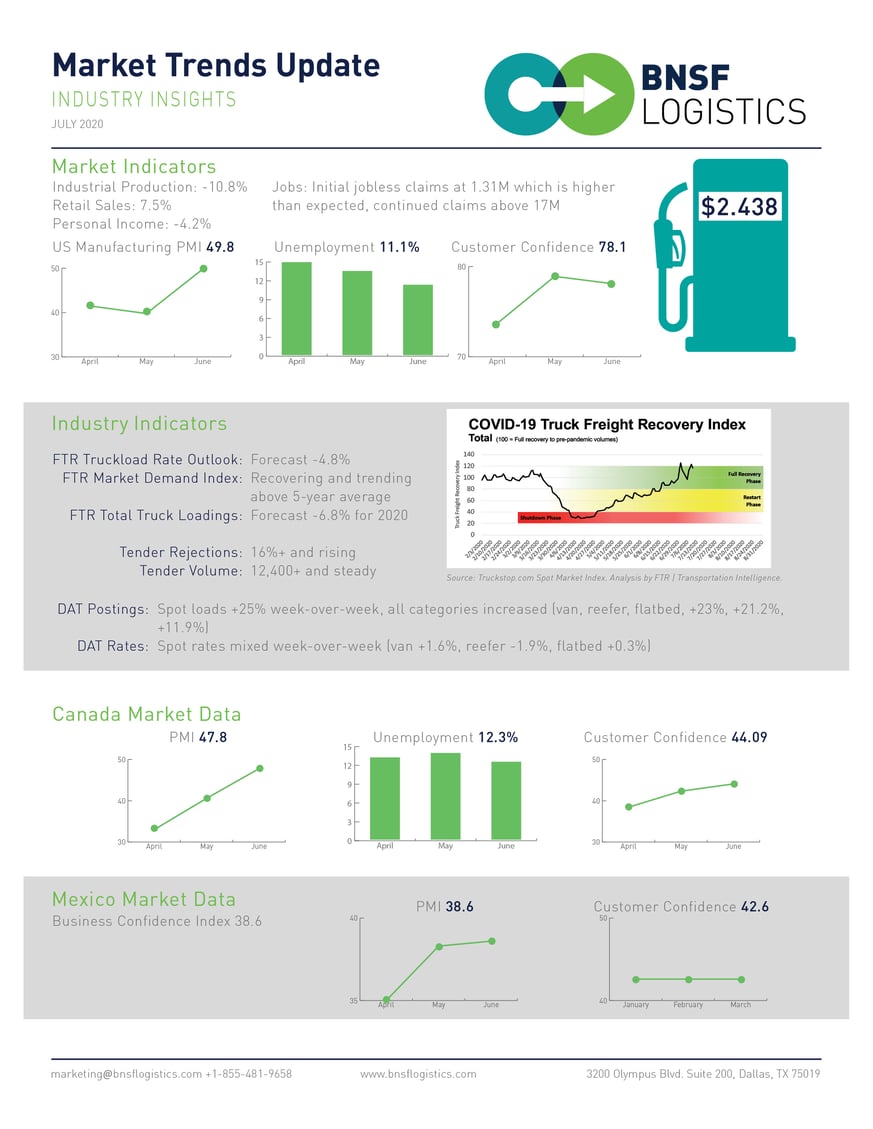

AS MARKET INDICATORS CONTINUE TO RISE, DATA INDICATES RECOVERY IS BEGINNING TO LEVEL OFF

As of mid-July, the market continues to improve monthly. However the U.S. manufacturing Purchasing Manager’s index (PMI) is at 49.8, indicating a small decline in U.S. manufacturing conditions. Industrial production continues to bounce back at -10.8%, compared to -15.4% over June.

The U.S. unemployment rate is down to 11.1% (compared to 13.3% last month) with initial jobless claims at 1.31 million. Consumer confidence is at 78.1 as of mid-July. Personal income is down 4.2% due to a decrease in government benefits.

Retail sales is up by 7.5% – two points higher than projected, suggesting a quicker recovery. Crude oil is approximately $40 a barrel, which is about double the price from a few months ago.

INDEX SHOWS AN OVERALL TIGHTENING OF CAPACITY NATIONWIDE

Tender rejections overall is around 16% and continues to rise, signaling tight capacity. In terms of length of haul, mid-haul was hit the hardest at 20% rejection rate, long-haul at 18.8%, and short-haul at 12.3%. Tender volume is 12,400, remaining steady and measured daily. Spot loads are up 25% week-over-week, and spot rates are mixed week-over-week.

FTR Truck Utilization is in mid-80’s. Although total truck loading for 2020 is slightly higher than projected at -5.7%, a return to pre-COVID levels is projected for 2021. As capacity tightens, tender rejections are on the rise. View FTR's State of Freight for more details.

BEST PRACTICE BY BNSF LOGISTICS

The market continues to fluctuate related to the ongoing COVID-19 pandemic. As the data changes daily, BNSF Logistics is committed to staying up to date with the latest industry statistics. Our main focus is applying this information in conversations with customers and carriers to help them make the best decision for their business.

Visit our COVID-19 Carrier Resources page for additional information to help you operate your business successfully.

Blog Home

Blog Home