In April’s Market Update, Managing Director of Strategic Account Management, Jeff Greenwell, provides industry touchpoints, truck utilization, and ideas on how to weather the current market during COVID-19.

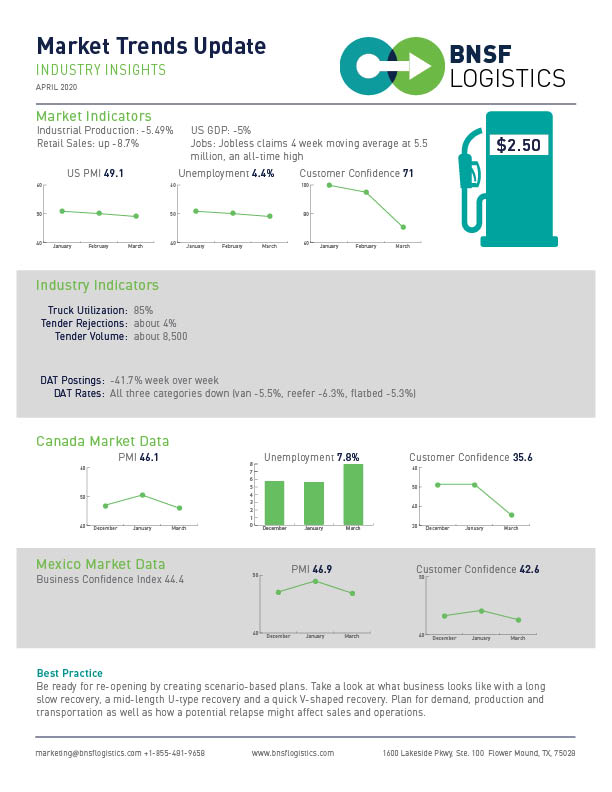

MARKET INDICATORS SHOW EFFECTS OF WORLD EVENTS

Industrial production is down 5.5% and the U.S. market is expected to remain volatile as states begin to reopen in stages. Unemployment has risen to 4.4%. Customer confidence dropped to 71, based on future outlook of the economy and the rise in unemployment.

U.S. GDP has dropped by 5%, which is believed to be an immediate COVID-19 drop that may be temporary. The Purchase Manager’s Index (PMI) has also dropped to 49.1 indicating slight contraction.

TRUCK UTILIZATION AND CAPACITY

Truck utilization is currently at 85%, while tender volume has decreased to 8,500 and holding steady, indicating a slowing and potential bottoming decline.

Tender rejections are less than 3%. The possible strain on U.S./China trade and potential political fallout may create an environment that results in manufacturing brought back to the United States. DAT postings have decreased, as have Van, Reefer and Flatbed spot rates.

MARKET-BASED PLAN OF ACTION

In an effort to combat current market changes, BNSF Logistics is focusing on how we can help our customers through scenario-based plans. We are discussing plans for a slow, long recovery, a medium “U” shaped recovery, and a quick “V” snapback recovery; and how each of those affects our customers and carriers going forward.

Blog Home

Blog Home